Banking and Financial Services Internship Experience

A comprehensive 10-week internship program focused on supporting loan servicing systems, optimizing account management workflows, and ensuring data integrity. Gained hands-on experience in IT operations, automation, process improvement, and data visualization, while while learning multiple banking systems and developing skills in Power BI and SQL.

Identified inefficiencies in current processes and developed recommendations to streamline operations and enhance customer experience.

Built interactive Power BI dashboards on HR key metrics and conducted data analysis to support decision-making.

Participated in training sessions on banking regulations, financial products, and professional skills development workshops.

Managed IT operations, created automation solutions, and optimized workflows to improve efficiency and reduce manual work.

Learned foundational SQL while working with company database systems, performing account analysis and data extraction to support operations.

Supported daily loan servicing operations, account management workflows, and system maintenance while ensuring data accuracy and integrity.

Major projects completed during the internship that contributed to business operations and process improvements.

Automated the report process using Excel Macros, cutting it from 53 steps to 3 (94% reduction) and reducing processing time from 15 minutes to 5 seconds (99% faster). Integrated loan officer lookups and ShowCase Query joins to eliminate additional manual steps, improving accuracy and associate productivity.

Automated the BOT Loan ExtensionDDC Report using Excel Macros, cutting processing time from 5 minutes to 5 seconds (99% faster). Generated Loss Mitigation, Denied, and Approved reports with automated formatting, file saving, and version control, eliminating repetitive manual work.

Automated the Liquid Payments Report using Excel Macros, reducing processing time from 8–10 minutes to 5 seconds (99% faster). The solution automated row extraction, formatting, and report generation into Charge Off Credits and Charge Off Payments, improving accuracy and significantly increasing associate efficiency.

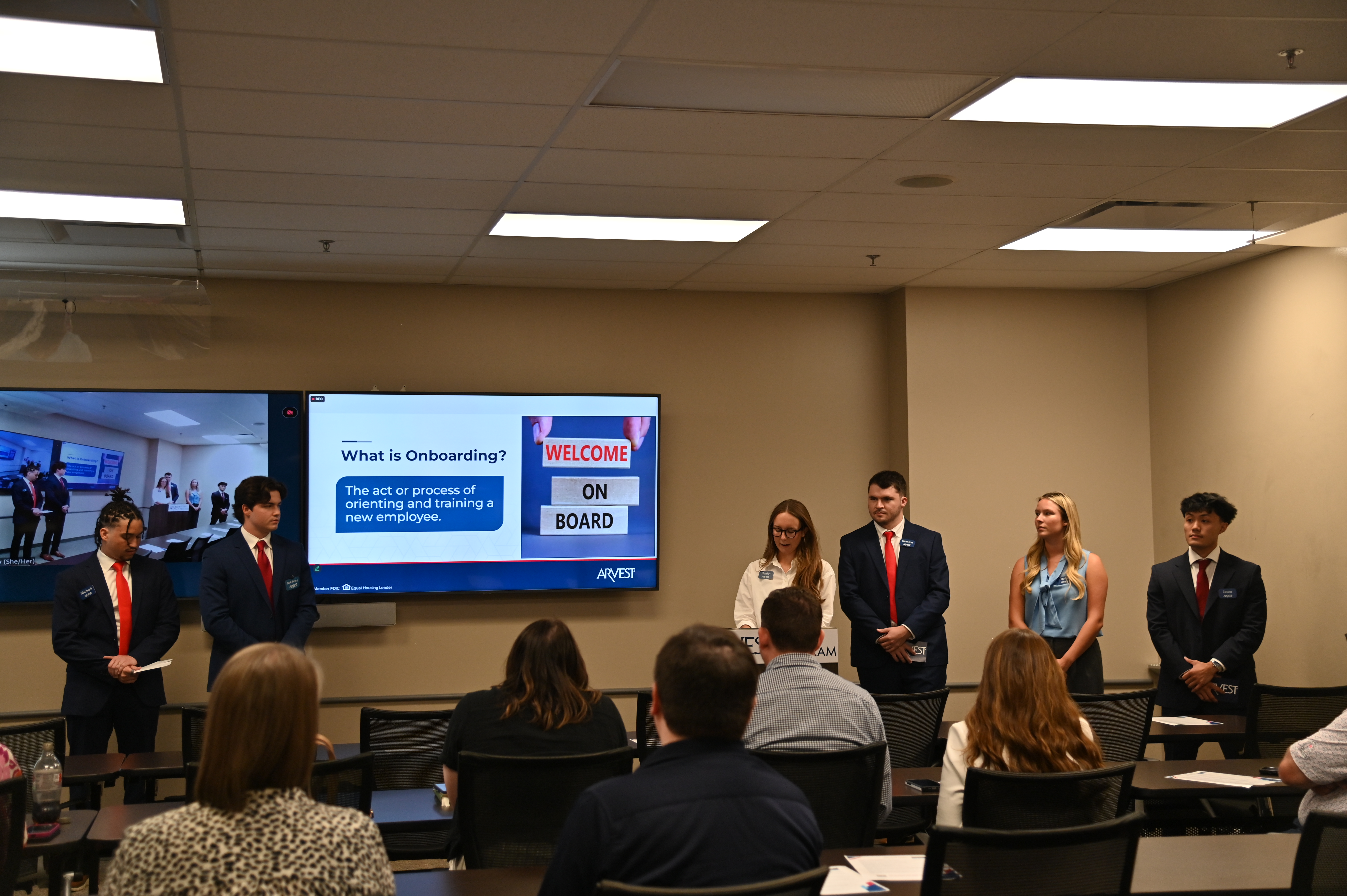

Analyzed Arvest Bank’s onboarding process to identify opportunities to reduce early attrition and improve time-to-productivity. Conducted HR KPI analysis, created data-driven recommendations, and collaborated with HR and IT teams to highlight efficiency gains and cost-saving opportunities.

Technical and professional skills developed during the internship experience.

Photos and moments captured during the internship experience.

Important documents, reports, and deliverables from the internship experience.

This VBA macro filters and organizes the Matured Line of Credit report, creates segmented sheets by loan maturity, and outputs the report automatically.

View CodeThis VBA macro formats the BOT Loan ExtensionDDC Report, creates Loss Mitigation, Denied, and Approved sheets, and saves the file automatically.

View CodeThis VBA macro automates the Liquid Payments report by extracting error rows, creating Charged Off Credits and Payments sheets, and formatting the output.

View Code